RenGaz $107 Million Tax Theft

Rengaz Holdings

This theft has not yet been recognized as a crime by the Russian government.

In 2006, one year before the theft of the Hermitage Fund companies and the illegal theft of taxes paid, the Klyuev Organized Crime Group organized the theft of $107 million of taxes paid by two companies of the RenGaz Fund, managed by the Renaissance Capital Investment Management Ltd.

Although the Russian government has never acknowledged the $107 million in tax refunds which were fraudulently made, and although the Russian government has never even investigated the fraud, it is clear that the money was indeed stolen from the Russian treasury. The modus operandi used in this crime was exactly the same used by the Klyuev Organised Crime Group one year later to steal the tax paid by the Hermitage Fund. The same Plaintiffs sued in the same courts, using the same lawyer, and relying on the same forged backdated contracts to fraudulently obtain court judgments for debts that did not exist. While this was going on, the companies were re-registered to the same corrupt tax offices No 25 and No 28 in Moscow, which would one year later refund to the Klyuev Organised Crime Group the taxes paid by the Hermitage Fund. Then, the companies opened bank accounts in the same bank, Klyuev’s Universal Savings Bank. All money was then refunded by the Moscow tax offices No 25 and No 28 to Klyuev’s bank, and the tax officers who approved the refund went on vacation to Dubai with Klyuev and traveled with Klyuev to Geneva where they had secret bank accounts. Officer Karpov celebrated by flying to London with Klyuev lawyers who fraudulently obtained the court judgments necessary for the fraudulent tax refund.

Despite being notified several times of this $107 million theft and being presented with all the evidence, the Russian government decided not to investigate because it apparently believes that the Russian people’s tax money are exactly where they are supposed to be.

Theft of the $107 million in taxes paid by RenGaz

Offering Memorandum showing RenGaz companies were managed by Renaissance Capital Investment Management Ltd.

[Download this document in PDF]

RenGaz was an investment vehicle offered by the Moscow Investment Bank Renaissance Capital. (please see the structure of the fund)

[Download this document in PDF]

The RenGaz companies realized hundreds of millions of dollars in profits for its investors and correctly paid $107 million of its investors’ profits in profits tax to the Russian government and then were sold.

However, that $107 million in tax was then stolen back from the Russian government by the Klyuev Organized Crime Group by obtaining sham court judgments in the same manner as they did with companies stolen from the Hermitage Fund a year later, in 2007.

Klyuev Group lawyer Pavlov participated in all sham court proceedings used to obtain a fraudulent $107 million tax refund

In 2006, lawyer Andrey Pavlov took part in multiple lawsuits claiming false debts filed against two Rengaz subsidiaries: Financial Investments (Finansovye investizii) and Selen Securities in the Arbitration courts of Moscow and Kazan. A year later, in 2007, lawyer Pavlov used exactly the same scheme with false debt claims against the companies stolen from the Hermitage Fund.

Filed Lawsuits:

Inter-Forum filed lawsuit against Finansovye investizii claiming in damages 6 687 600 062.40 rubles (US$241 mln). Inter-Forum was represented by lawyer Andrey Pavlov

http://www.rostnadzor.ru/arbitr/A40-16205-06/

Anri-Line filed lawsuit against Finansovye investizii claiming damages 2 312 400 384 rubles (US$85 million). Anri-Line was represented by Andrey Pavlov

http://www.rostnadzor.ru/arbitr/A40-12328-06/

Optim-Service filed lawsuit against Selen Securities claiming damages 1 925 999 604 rubles (US$72 mln). Optim-Service was represented by Andrey Pavlov

http://www.rostnadzor.ru/arbitr/A40-16204-06/

Prior filed lawsuit against Selen Securities claiming in damages 564 000 460,80 rubles (US$20 mln). Prior was represented by Andrey Pavlov

http://www.rostnadzor.ru/arbitr/A40-12329-06/

Poleta filed lawsuit against Finansovye investizii claiming in damages 10 105 039 188 rubles (US$369 mln). Poleta was represented by Andrei Pavlov

http://docs.pravo.ru/cases/list/?f_cases%5B%5D=%D0%9065-6851%2F2006

Lawsuits were based on forged agreements and were practically identical

[Download this document in PDF]

Lawsuit of Poleta vs Finansovye investizii signed by Andrey Pavlov was based on forged agreements where the Plaintiff signed the “Agreement for Supply of Securities”, and the “Addendum to the Agreement” specifying particular securities to be supplied. The third document signed was the “Cancellation Agreement” in which the party, who allegedly failed to supply any of the promised securities, agreed to provide compensation for loss of profit which would have arisen from the appreciation of those securities. This sum amounted to billions of rubles.

Please see forged agreements between Poleta and Finansovye investizii:

[Download this document in PDF]

Lawsuit of Optim-Service vs Selen Securities was also signed by Andrey Pavlov and appears to be identical to the previous one

[Download this document in PDF]

……and was based on three agreements: “Agreement for Supply of Securities”, “Addendum to the Agreement” and “Cancellation Agreement” which were similar to the previous lawsuit.

[Download this document in PDF]

Lawsuit of Inter-Forum vs Finansovye Investizii was also signed by Andrey Pavlov in identical terms.

[Download this document in PDF]

….and was based on three agreements: “Agreement for Supply of Securities”, “Addendum to the Agreement” and “Cancellation Agreement” – similar, again, to the previous lawsuit.

[Download this document in PDF]

In the same manner as a year later against companies stolen from the Hermitage Fund, the defendants in the sham cases consent to liabilities that never existed.

[Download this document in PDF]

As a result, the Moscow Arbitration court awarded US$90 million against Selen Securities and the Kazan Arbitration court awarded US$368 million against Financial investizii.

[Download this document in PDF]

The decisions were received by Andrey Pavlov personally.

[Download this document in PDF]

Former RenGaz companies are moved to Tax Offices 25 and 28

These sham liabilities were used to file the amended tax returns and request a tax rebate. Prior to the tax refund application, two former subsidiaries of Rengaz were moved to Tax office No. 25 (Selen Securities) managed by Elena Khimina and to Tax office No. 28 (Finansoviye investizii) managed by Olga Stepanova.

[Download this document in PDF]

[Download this document in PDF]

Bank accounts are opened in Klyuev’s Universal Savings Bank

Two former subsidiaries of Rengaz – Financial Investments (Finansovye investizii) and Selen Securities – opened accounts with Universal Savings Bank.

Soon after the accounts were opened, as a result of the illicit money wired to their accounts, Financoviye investizii and Selen Securities became the top depositors in the Universal Savings Bank.

[Download this document in PDF]

Klyuev’s admission that he owns and controls Universal Savings Bank

[Download this document in PDF]

[Download this document in PDF]

Testimony of Dmitry Klyuev, Criminal Case No. 1-215/06 Presninski Court, 4th August, 2005:

“Actually it was my bank. I bought this bank in November 2004 from the former owners and re-registered it to a number of companies effectively controlled by me, where nominee directors and shareholders of such companies were friends of Mr Sergei Orlov, who I knew for several years. The Board of Directors of the bank was also a nominal body and consisted of the same friends of Mr Orlov. All banking operations were managed by me.”

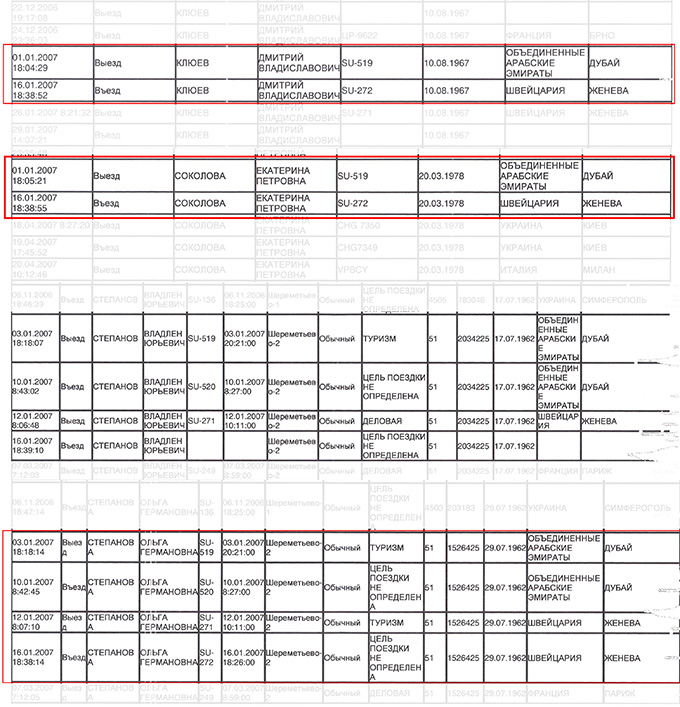

Travel Record: Klyuev & Stepanovs – Vacation in Dubai after $107 million theft

Klyuev, the owner of Universal Savings Bank, which received the fraudulent $107 million tax refund, vacations in Dubai with Tax Officer Stepanova and her husband, Vladlen. Stepanova was the head of Moscow tax office No 28 who authorized the $107 million tax refund.

Several days after their trip to Dubai, the same group met in Geneva where Stepanova’s husband had opened secret bank accounts to receive the stolen money. Thereafter, Klyuev, Stepanova and her husband returned together to Moscow.

Trip to Dubai and Geneva January 2007 Klyuev and his wife, Sokolova; Tax Officer Stepanova and her husband, Stepanov

Trip Dubai Geneva January 2007 Klyuev, Sokolova, Stepanov, Stepanova

[Download this document in PDF]

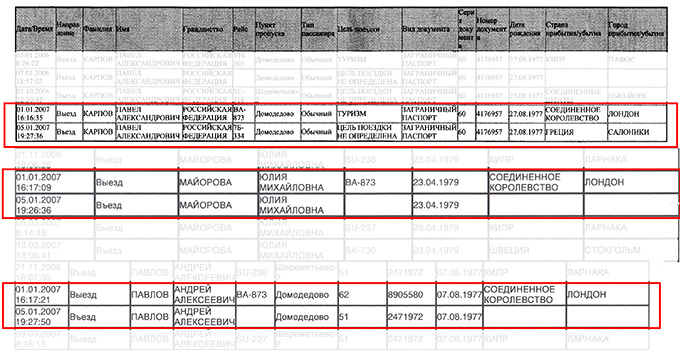

Travel Record: Karpov, Pavlov & Mayorova – London

Trip to London January 2007 Officer Karpov, Lawyers Pavlov and Mayorova

Trip to London January 2007 Karpov, Pavlov, Mayorova

[Download this document in PDF]

Soon after the $107 million refund, Interior Ministry Officer Karpov together with Klyuev’s lawyers Pavlov, who prepared all the court documents used for the illegal $107 million tax refund, and his wife, Mayorova, together celebrated their success. They flew to London on New Year’s eve 2007, and then back to Moscow a few days later.

Yulia Mayorova’s UK Visa application

In her visa application to the UK Border Agency, Yulia Mayorova stated that she is travelling with Officer Pavel Karpov, another member of the Klyuev criminal group.

[Download this document in PDF]

To learn more about what happened to Sergei Magnitsky please read below

- Sergei Magnitsky

- Why was Sergei Magnitsky arrested?

- Sergei Magnitsky’s torture and death in prison

- President’s investigation sabotaged and going nowhere

- The corrupt officers attempt to arrest 8 lawyers

- Past crimes committed by the same corrupt officers

- Petitions requesting a real investigation into Magnitsky's death

- Worldwide reaction, calls to punish those responsible for corruption and murder

- Complaints against Lt.Col. Kuznetsov

- Complaints against Major Karpov

- Cover up

- Press about Magnitsky

- Bloggers about Magnitsky

- Corrupt officers:

- Sign petition

- Citizen investigator

- Join Justice for Magnitsky group on Facebook

- Contact us

- Sergei Magnitsky